News and Articles

There are a lot of risks, exciting opportunities, and mind-bending facts regarding cryptocurrencies. In this article, I provide a quick overview of considerations relevant to a Family Office or any other institutional investor, looking for the first time to take a position in crypto – particularly relevant for quantitative crypto hedge funds. Introduction There is a proliferation of investment products in the cryptocurrency space and growing adoption by institutions. PWC estimates that crypto hedge funds doubled their AUM from 2019 to 2020 (estimated to be $2 billion in May 2020), with the vast majority of investors being Family Offices (48%) or high-net-worth individuals (42%). A similar and probably stronger growth is expected in 2021 following the large strides in infrastructure, regulatory/legal clarity, and the recent surges in crypto prices. In December 2020, the transaction volume of digital currency derivatives reached $2.7 trillion (this is not a typo), and during this January inflows into Bitcoin and other crypto assets hit $1.3 billion . Managers, insurers, pension funds, corporate treasuries, and even Investment banks have reportedly started dipping their toes into crypto. Insurance giant Mass Mutual in December made a relatively tiny “ measured yet meaningful exposure ” of $100 million in Bitcoin. Morgan Stanley only last week announced that they’ll offer cryptocurrency to their wealthy clients, and Deutsche Bank is about to offer institutional custody and prime brokerage . Investors are increasingly making such allocations for diversification or as a London-based $17 billion traditional asset manager with 2.5% of assets in crypto says, it is a “small but potent insurance policy against the continuing devaluation of the world's major currencies”. A clear market trend is emerging.. but it’s a complex and difficult space In the author’s opinion, we are witnessing the birth of a brand new institutional investment class, with still a lot of potentially profitable information asymmetries that may assist in wealth preservation and generation, and with low correlation to the traditional markets. Deciding whether a crypto investment is appropriate for an institution is a topic that I will not cover here. However, for those convinced that it is time to enter this space. how does one go about it? Examining the risks and opportunities of any complex quantitative investment and how these factors are aligned to the investment scope and purpose of an institution is a deep & complex topic on its own. Hedge funds are speculative and always involve a high degree of risk, and the very technical and novel aspects of the crypto space and its emerging infrastructure introduce new unknown dimensions – I briefly mention some of those below. In my career as an Investment Banker in tier 1 banks, I’ve built, traded, and sold hundreds of quantitative investing strategies and indices in FX, Precious Metals, and Commodities, and before my involvement with crypto, I’d still find this space mind-boggling. Elements of an effective crypto hedge fund investment Due Diligence process The typical Due Diligence process for alternative investments covers all qualitative and quantitative elements of a hedge fund, after it has been selected as a potential opportunity. The process involves thoroughly reviewing the documentation, people, investment philosophy, investment process, portfolio construction, risk management, fee structures – among other information. Although the same process can be applied in crypto hedge funds, there is a large extra set of complexity and a lot of different questions that need to be asked compared to funds trading in the traditional mature markets. Just to name a few, each currency involves different technical and crypto market considerations, exchanges can suddenly pop out of existence, the value drivers behind a strategy can expand or disappear due to a technical/market/regulatory reason that may be temporary or permanent, and infrastructure providers could be major sources of risk, too. There are parts of the market full of insiders that can swing markets in either direction utilizing hidden stashes of wealth. When reviewing a fund prior to investing, one needs to achieve clarity on the above from the hedge fund’s managers, and see proper explanations in the documentation received. Each of these aspects needs to be evidenced and analyzed and disambiguated for the Family Office’s investment committee, executives – potentially even for the principals. Having already assisted institutions in such crypto hedge fund reviews, I can reveal that it can be a very interesting bespoke challenge every time. And it doesn’t end there. Hedge fund investment mandates may be broad and managers have considerable latitude in managing their portfolios. Thus, ongoing investment monitoring and due diligence are important, for oversight of any performance/market/strategy/team change that could be an early warning sign or risk beyond the investor’s comfort. Even the basics should be questioned here, like the investment vehicle one uses to access the intended crypto exposure (perpetual swaps, ETFs, trusts, funds, etc.) as each comes with its own opportunities, peculiarities, and risks that investors need to understand and be comfortable with. As an example, investing through a trust makes someone potentially exposed to large dislocations. In December last year, one of the most prestigious Bitcoin trusts with an estimated $25 billion in AUM, was priced 40% above the value of the currency it held due to the soaring investor demand. An equivalent swing to the other side may appear at times of massive exits from such investments. But do not despair – risks are to be understood and managed. “I am a Family Office without crypto expertise, but can’t wait on the sidelines – what can I do?” Any investment firm, that has not yet cut its teeth on this space to comfortably satisfy its fiduciary duties, has options. Until the in-house expertise is built to analyze and manage such investments, one can hire experts capable to undertake a proper crypto Due Diligence or build the internal institutional capacity for such activities. However, the credentials and vintage of experts need to be thoroughly checked, to steer away from those with low expertise who recently got attracted to this space for its tremendous potential growth. With the right guidance, this may turn out to be a very rewarding pursuit – intellectually and financially – but as with every investment, make sure you don’t get carried away by crypto FOMO*. (*FOMO: acronym of “Fear of Missing Out”, a frequent phrase in crypto trading indicating someone getting carried away by chasing returns) Note: This is for informational purposes only and not financial, investment, or other advice. ----------------------------------------- #institutional #investments #familyoffice #singlefamilyoffice #wealthmanagement #crypto #hedgefunds #duediligence #blockchain #digitalassets #treasury #pensionfund

Emotion is one of the most important human traits as it provides meaning, color, and texture, to a message. Ignoring the way that a certain phrase or word sounds, the tone or stress in the speaker’s voice or their body language makes the message frequently unclear. We have entered an era of exponential improvements in the technology and the ways that intelligent machines assist us in an ever-increasing list of tasks. From getting Amazon’s Alexa to play some feel-good tunes or ask Microsoft’s Cortana to answer a trivia quiz question we don’t know, to navigating to that delicious BBQ restaurant in Brooklyn with Google Maps, to completing a bill payment on the phone with a digital banking robotic assistant. These are just some of the interactions almost all of us have in our daily lives, and now consider as a given. But most importantly, these are more or less one-way. We feed the machine a request (“get me to Hometown BBQ in Brooklyn”) and the result is returned in a combination of visual and sound aids (to get you there). One could rightfully argue that emotional information in your request does not add any value there – the navigation result would be the same whether you spoke naturally, or whispered while weeping from hunger. Still, emotions are very important for groups of users that need to interact with technology differently. “Higher tasks” like senior citizen interactions with humanoid robotics to provide company, emotional support applications for persons with autistic spectrum disorders, stress diagnosis in various contexts (professional for employee safety, or personal), quality basic social services at a fraction of the cost, crisis monitoring and management among others. Inventor and futurist Ray Kurzweil pegged the date on which Artificial Intelligence will do... Continue reading my original post on LinkedIn

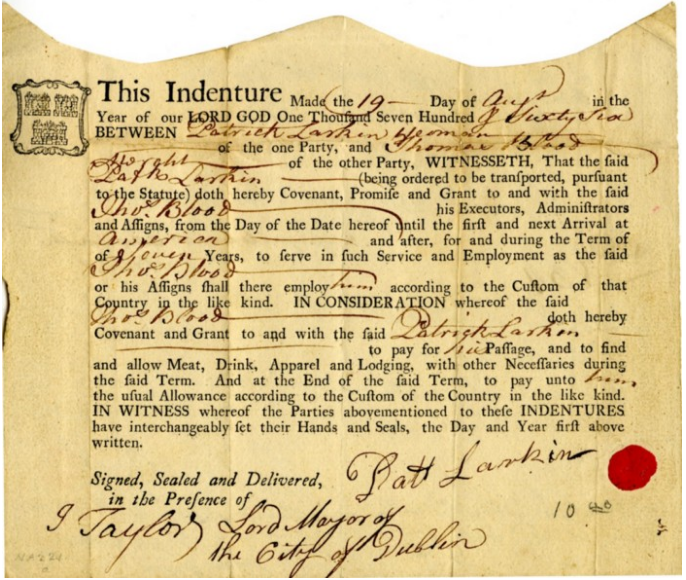

This article is part of the “Capital Markets: Past, Present, and Future” Series. The previous article presented a plethora of modern-day key technologies, capabilities and trends, impacting financial services firms in many varied ways — some obvious, but some esoteric to how the financial markets behave. This article talks about one technology driver which is arguably the most impactful for the capital markets, blockchain technology. “What is the question for which blockchain is the answer? Trust.” — Edward Snowden, Nov 2018 The earliest forms of “contract authentication” literally existed in the form of a random tear at the top of the contract, like the one shown here from 1766. Blockchain represents the evolution of authentication, which carries many implications for its ability to facilitate trust. What is Blockchain? We live on the cusp of a significant digital transformation. Everyone has heard about the blockchain, the technology powering Bitcoin, which was originally developed by hackers and open-sourced. It is so powerful that within less than 10 years it is applied to the most demanding and complex financial sector. Despite the big noise around blockchain in the media, simply put it is a ground-breaking technology that for the first time in human history solved the big problem of how to create and maintain scarcity in digital assets. Two or more parties, without knowing each other, can forge agreements, transact, and build value without relying on middlemen to verify their identities, establish trust, or perform the operational side of the business (e.g. contracting, transferring value, record-keeping). With transactions having to be verified by a wide array of users (the “nodes”) as opposed to single trusted parties, transparency and security can be enhanced. The potential applications go beyond finance and have opened the way for contracts that exist on the blockchain and perform autonomous tasks to execute “trustless” business logic (hence called smart contracts). There are now countless implementations and permutations — for a deep dive in the taxonomy for blockchains, read here . Why Does it Matter? A secure and trusted database that does not have a single point of failure has immense potential implications for capital markets. Disintermediation From cross-border payments to real estate to bespoke investment solutions , virtually all transactional activities have a middleman that facilitates the respective process for a fee. With its cryptographic security, distributed transparency, and digital format, blockchain is able to disintermediate a significant portion of these processes and leading to a faster, more efficient, transparent, and correct market infrastructure. Among other examples are peer-to-peer lending and transacting. This massive released value goes towards cost savings in financial services firms and, most importantly, makes finance affordable and accessible to most investors. ResonanceX demonstrated this and the reductions in cost, time and risk at the world’s first structured investment on a blockchain in Q1 of 2018. Tokenization of illiquid assets This is another game changer. One is able to have secure ownership of an asset, either for themselves or shared with other people, with zero paperwork and completely verifiable. This matters in cases where the asset may be physical and transactions typically involve high execution costs. As I write this, I am only a stone’s throw away from the founder of RealBlocks (he was kind enough to lend me his umbrella yesterday) — they successfully apply blockchain in real estate in this exact fashion. Tokenization also enables fractional ownership (i.e. splitting a large deal into many smaller pieces), which makes assets previously reserved only for the ultra-rich or the large institutions, accessible to everyone by significantly lowering any barriers to entry. A single golden source of truth The number of inefficiencies, and potential for fraud as a result of bureaucracy and legacy infrastructure in industry and government cannot be underestimated. There is immense amounts of information on different databases (e.g. transaction data, trade information, records of ownership) generated at different parts of a process, different entities within an ecosystem or company, or at different periods or geographies. The impact of blockchain technology is the massive operational simplification and data transparency between many parties, e.g. elimination of out-of-sync ledgers, need for reconciliations, and no fragmented or hidden data that yield multiple versions of the truth. We have already seen supply chain management pilots, platforms for contract negotiation and management, as well as others enabling physical items to have proof of authenticity, existence, as well as ownership. Decentralized identity A far-reaching implication is decentralized identity. Just like blockchain can be used as secure custody of real or digital assets, the same can be applied to our actual unique identities. Put simply, our passports, birth certificates, ID cards, banking information etc. can be placed on the blockchain which can then serve as our proof-of-identity when accessing countries or establishing citizenship. When applied to finance, our digital identities can facilitate instant identification and anti-money-laundering verification, vastly improving customer experience but also reducing relevant risks when opening bank accounts, investing, etc. One area in focus: Custody of digital assets A proliferation of cryptography-based digital assets means that investors will be able to transact in a peer-to-peer fashion, but will still need to have these assets safeguarded from loss and theft. Such an important regulated function that applies to traditional finance (e.g. stocks, bonds) has to dematerialise for the digital world. The UK’s Regulator (Financial Conduct Authority) has already recognised that under the... Continue reading my original post on Medium.

The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source. The above claim is not mine - it is the outcome of the recent 2018 CEO survey by Gartner (world’s leading research and advisory company). By 2030, 80 percent of heritage financial services firms will go out of business, become commoditized or exist only formally, struggling to compete with global digital platforms and Fintech (financial technology) startups. Therefore, it is no surprise that many major global financial firms are investing unfathomable amounts to stay competitive. This article marks the fifth instalment of the series, “Capital Markets: Past, Present, and Future”. While we have slowly unraveled the web of complexities inherent in capital markets, and the reasons for technological stagnation, inefficiencies start to become clear. And when you put these inefficiencies against the backdrop of today’s technologies, it really stresses the urgency to evolve. Image for post “Software is eating the world” — Andreesen Horowitz Andreesen Horowitz’s famous investment thesis above has unfolded under our very eyes and day-to-day lives, and capital markets are no exception to this rule. So let’s dive deeper into the tools at our disposal to drive the future’s tectonic shifts in the sector... This deliberation is endless and admittedly one of my favorite topics; therefore for the sake of clarity and brevity, this article will remain at a high level. Below is a plethora of key technologies, capabilities, and trends currently impacting the capital markets’ evolution. The implications are myriad; some obvious, while others esoteric. For the discerned reader looking for more, the included references are a good starting point for each topic. Drivers of change End-to-End Automation Automating all processes in a streamlined workflow without unnecessary interference by people, significantly reduces operational costs, risks, and headaches. Automation not only vastly speeds up customer experience (e.g. the potential customer-churning client onboarding ), but also allows firms to scale their activities significantly without ceilings resulting from inefficient processes. Automation in investment management also fuelled the massive shift towards passive investments over the past two decades, and more recently robo-advisors / systematic investments . Legal Contract Standardisation and RegTech This driver results in significantly reduced overheads to draft, negotiate, and confirm legal and marketing documents. In the cases of financial contracts, it minimizes the risk of legal or regulatory misalignment with a trade’s economics. See this article by EY that expands on the topic. Vertical Integration Properly structured data that flows seamlessly across an entire organization eliminates duplicate / incompatible data or systems and the necessity for bespoke or human interfaces. Vertical integration also provides significant improvement of management, finance, and compliance oversight as all activities can be monitored versus a firm’s Key Performance Indicators . For a deeper dive into the topic, see here . Artificial Intelligence This technology mimics human problem-solving and decision-making processes allowing financial services firms to operate more efficiently , reduce fraud, explore new revenue streams, and interrogate the rich data sets hidden in their databases and the economy at large. Robotic process automation will.. Continue reading my original article on Medium .

The previous article dove into the murky waters of the financial services’ stagnant infrastructure. We concluded that even though a large proportion of organizations face challenges when undergoing digital transformations, fortunately, the business and financial opportunities for those decisive enough are boundless. This article marks the fourth installment of the series, “Capital Markets: Past, Present, and Future”, which covers the current challenges, the applicable technologies, and how some Fintech (Financial Technology) companies are harnessing the tides of change in capital markets today. It elaborates on the reasons why financial services firms have not been moving faster to upgrade their technology — leading to cost reductions, new revenue streams, and improved customer service. Why is financial technology adoption so sluggish? Adoption of the right technologies could be faster. Banks and other capital markets participants have been investing in automation and Fintech startups over the past few years but the outcomes are still debatable. Below are some of the key reasons, reflecting multiple discussions with professionals in the industry — some with ex-colleagues and some not. Growing by Accumulation The larger banking institutions have grown primarily through the accumulation of smaller financial firms across the globe. As a result, they have inherited multiple, often redundant, and sometimes incompatible technology systems. Furthermore, these “silos” can be more than just digital — organizations may struggle to integrate teams and break down cultural, language, or other barriers inherent in acquisitions. Such challenges are not exclusive to the financial services industry, but that does not make them less real. Organic Growth Turning into “Shoehorning” Most large firms today have typically started small and at grew over time to become successful. In the beginning, firms utilize simple or bespoke IT systems that cover their limited needs. Growing fast, however, may lead to a situation where — in the interest of saving time and money — necessary IT upgrades/extensions get kicked further down the road or outright omitted. This eventually leads to new products being shoehorned into existing old systems, with “creative” patchwork and semi-manual processes. This “shoehorning” leads to a constant need for supervision and support or even worse, acceptance that relevant errors are a cost of doing business. Such outcomes are antithetical to the idea behind having IT systems. The Lesser of Two (or Three) Evils Whether they got here by acquisition or organic growth, many companies in the financial services are faced with a challenge. On one hand, challenges and security risks may surface when decommissioning legacy architecture with newer technology. On the other hand, preserving legacy IT puts hard limits on the obtainable benefits. It should come as no surprise that there still are systems in financial services firms that are almost impossible to integrate — the cost of doing so is seen as prohibitive unless it is a matter of life and death. The third option, outsourcing, is difficult — past client data breaches have had severe consequences from direct financial impact to reputational damage and churn. In such a highly regulated industry and in a context of heavy cost pressures, management tends to optimize for maintaining stasis, opposed to accepting the transformation process’ risks or a likelihood of an embarrassment. Short-Termism and Politics — Safe Havens in Uncertain Times Only blaming past choices for the sluggish adoption of financial technology is missing the forest for the trees. Legacy IT systems don’t run companies, people do.. A short-term outlook is a big barrier to lasting change. Companies may assume such a perspective during periods when the market, the economy or regulatory developments are hard to predict. At the same time, it is common for long-term strategic initiatives to face resistance from employees, even at senior levels. The new strategy can lead to restructuring, which leads to reduced team headcounts and even reduced personal gravitas within a firm. Research also points out that investors further exacerbate short-termism by their ever-shorter holding period of stocks . A short-term outlook introduces existential threats to financial services firms, particularly with the sheer volume of Fintech activity today. Revolving Doors and Planning Cycles Similar to politicians, business leaders often need to demonstrate progress and value generation within a short period of time; thus longer initiatives are often lost in translation. According to Equilar in a recently published post on the Harvard Law Forum on Corporate Governance and Financial Regulation, the average tenure of an S&P 500 CEO at the end of 2017 was only five years. This makes many CEOs focus on... Continue reading my original post on Medium.

In their current form, capital markets are in dire need of “tilling” to be transformed. The previous article looked at how financial services firms operate with fragmented and legacy infrastructure through the lifecycle of a Structured Investment*, a type of investment that carries a higher degree of complexity compared to stocks or funds, but offers better risk-return characteristics. This article marks the third instalment of the “Capital Markets: Past, Present, and Future” series, that covers the current challenges, the applicable technologies, and how some Fintech (Financial Technology) companies are harnessing the tides of change in capital markets today. It presents some of the important consequences resulting from the stagnant infrastructure used in financial services. So let’s dive into the murky waters to see just how these issues affect capital markets. Reliance on manual processes It is not a secret that a big part of the financial services industry is plagued by manual processes, reliance on paper documentation, and multi-channel client communications (e.g. emails, phone calls, text messages) that can all lead to errors, delays, high compliance risks, and require constant oversight. In some cases, there is still a need for manual human reconciliation of information between systems, when such systems just cannot be modified to communicate among each other. A common reason is the rigidity of some of the current legacy IT systems, that makes them extremely hard to modify, or to interface with more modern systems, without introducing data security risks. This makes for a prime opportunity to deploy agile and flexible technologies, as long as they operate in a robust data-secure environment. A result of this is the tendency to prefer open architecture and open-source code, adopted across industries — the other end, where most firms currently are, is using bespoke, one-off systems, only to eventually realize that firms using them are captive by the vendor, their development resources bottlenecks and their pricing structure. Reduced Profitability A consistently high-cost base arises from the need to employ large operational teams or managing the regulatory requirements which are a chronic friction point for financial firms and their shareholders — weighing down on profitability and revenue growth. For larger businesses, this has a lesser effect due to economies of scale. Regardless, it forces them to limit activities to high revenue-generating market segments or transaction types, which could potentially lead them to exit from whole markets or businesses. To put this in perspective and take an example from the Asset Management industry, when examining 153 leading firms in 43 markets representing $43 trillion (more than 62% of global assets under management), Boston Consulting Group found that in 2017, global profits decreased 2% as net revenues fell 1% and costs remained unchanged . This troubling fact is not a recent development and definitely not isolated in this particular part of the industry. Missing out on the “data treasure trove” It is a well-known fact that the amount of digital data generated by human activities is growing exponentially. When a firm does not have the right infrastructure, it becomes very hard to generate value from the extremely rich client activity information in its technology stack, which could improve the client experience and the firm’s profitability. The historic approach of competing only in revenues, rather than catering for the client needs, is no longer working. This also led to reduced client engagement and increased risk of challenger startups incrementally capturing market share. Even though banks and other financial services firms are aware of the immense value locked in their systems, it is costly and slow to leverage this value without replacing these systems completely, or without introducing risks from having external providers access and process client data. By embracing data, financial services firms cannot only significantly reduce fraud levels in real time (global card fraud alone is estimated to exceed $35 billion in 2020 ), but can also create customized experiences for clients by optimizing their transactional, investing, and behavioural interactions. The same data-led insights can also drive management decisions towards alignment to their key performance indicators and strategic vision. Below is a concise illustration provided by McKinsey of how data-informed analytics can provide significant value to financial services firms:

This article is the second instalment of the “Capital Markets: Past, Present, and Future” series, that covers the current challenges, the applicable technologies, and how some Fintech (Financial Technology) companies are harnessing the tides of change. The previous article presented the thesis that after decades of insufficient and unbalanced technology adoption in the financial services industry, capital flows to Fintech have substantially increased to remedy the problem. Such conditions are rarely not a preamble of significant developments.

HSBC has launched its first algorithmic foreign exchange index, known as the global FX carry index, in response to increasing client interest in alternative products and protection from volatile market conditions. The HSBC Global FX Carry Index was launched yesterday and considers 32 currencies, including both G-10 and emerging markets. Currency carry strategies, which have long been popular with investors, involve investing in high-yielding currencies while borrowing in low-yielding currencies. The bank this week unveiled the HSBC Global Carry Index, which looks to profit from the popular FX investing style in a universe of 32 liquid currencies that excludes those that are heavily managed or pegged. Although FX carry indices have been around for years, HSBC believes its index will benefit by learning from the mistakes other institutions have made, both by mitigating the inherent risk of a sudden drawdown in the strategy and by extending the range of currencies available for inclusion. However, the problem for investors is that they are prone to sudden reversal if risk appetite is disrupted and heightened volatility forces a wave of position deleveraging, such as that provoked by the collapse of Lehman Brothers in 2008 HSBC first created a benchmark carry index, which simply consists of a basket that is long of the five highest-yielding currencies among the 32 in its model, and short of the five lowest-yielding currencies. The basket is equally weighted and rebalanced each quarter. Unsurprisingly, the benchmark performed well ahead of the financial crisis, but was prone to large swings thereafter, with intermittent sudden and large losses. Security measures HSBC calls the first the value-preserving mechanism. The algorithm monitors the relative volatility of each currency and excludes those that display volatility above a certain level. Furthermore, it assesses how many currencies exhibit relatively high volatility and defines the world to be in three states: calm, medium, and volatile. Depending on which state the world is in, the algorithm will either have a 100%, 60% or 0% exposure to carry, meaning a basket of five long and five short currencies, of three long and three short currencies, or nothing. The second mechanism is a stop-loss trigger, which is enforced if the index drops below 96% from the maximum of the previous six months. When the market calms down and the carry strategy starts to pick up momentum again, the strategy reallocates back into carry. HSBC says the benchmark index, which it back-tested to December 2004, has average annual returns of 3.9%, with annualized volatility of 10.6%, giving a relatively low Sharpe ratio of 0.37. The maximum drawdown during the Lehman crisis was nearly 28%. In contrast, the HSBC Global Carry Index has an average annual return of 8.8%, volatility of 5.8% and a Sharpe ratio of over 1.5. The maximum drawdown was below 6.5%.